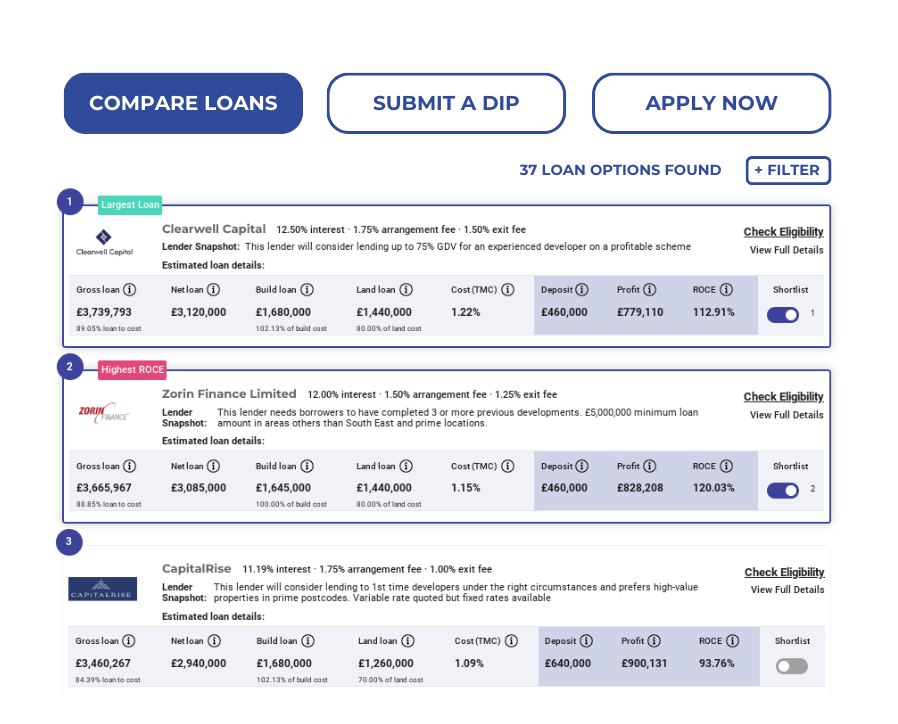

Compare 100+ specialist property finance lenders & secure a Decision in Principle today

We connect brokers & borrowers with lenders to source the best value bridging loans, commercial mortgages & development finance quickly & easily.

The most efficient journey to specialist property finance

We understand your frustrations when it comes to securing commercial property funding. That’s why we created Brickflow; a digital marketplace where you can model deals, source and apply for specialist property finance, all in one place.

We provide instant access to 100+ lenders and the most streamlined way to secure a Decision In Principle; our record stands at 8 minutes. Unheard of in our industry, right?

Not anymore.

Model deals

- Check viability before pursuing a project

- Increase certainty on every deal

- Check your project meets lender criteria

Save time

- Search the breadth of the market in minutes

- Receive instant search results & a same-day DIP

- Digitally connect with lenders, so there’s zero paperwork or delay

Save money

- Find the best value loan

- View ROCE against every lender on every deal

- Get more deals done with quicker, easier borrowing

Scale sooner

- Free up time by completing on more deals

- Spend time saved growing your revenue

- Scale your business faster

Brokers

- Search & apply for specialist property finance

- Embed Brickflow Enterprise & expand your reach

Borrowers

- Model deals to ensure your deal stacks

- Check lender criteria & apply through a lending manager

Agents

- Increase deal certainty & conversion

- Reduce time-wasters & capture serious buyers

"The benefit of Brickflow is instant information in a snapshot. You can see what various lenders are going to offer you, meaning you can move more quickly on deals and put an offer in."

"This is incredibly useful technology. Twelve months ago, we knew what lenders' pricing and appetite was - but today, in an ever changing market place, it's incredibly difficult to keep up."

Register Now

Sign up to Brickflow from just £32 per month & earn 100% of the commission on every deal.

Compare Loans

Search loans from 100+ lenders, model deals & secure the best value development finance, bridging loans and commercial mortgages.

Partner With Us

Register now to help your clients secure development finance faster & reap the rewards.

.webp)